We are swiftly approaching a cashless world. Our dependence on cash has shifted from cashless transactions to the Cash App. Digital cash apps have grown in popularity over the last few years due to their convenience, security, and ease of use. Cash apps provide a one-stop solution to the growing demand for quick, safe, and simple digital payment options. As more individuals use smartphones and other digital technologies, cash apps are set to become an increasingly significant element of the financial ecosystem.

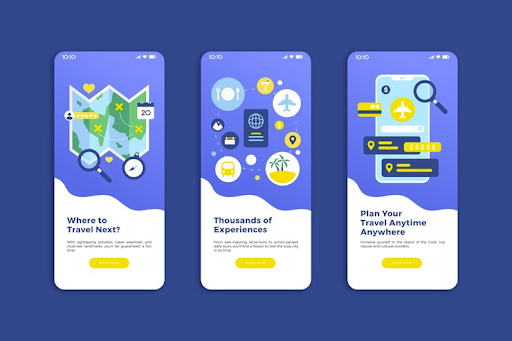

Cash App clone development has emerged as one of the most popular of the many payment apps available. It allows users to send and receive money, pay bills, and invest in stocks via a single app. This page discusses the benefits and features of payment applications and the most recent statistics and cost estimates.

Key Statistics Around Payment Apps

- According to Business Wire, the total value of contactless payment transactions is estimated to exceed $10 trillion by 2027. Furthermore, the worldwide fintech sector is predicted to grow to $211.64 billion by 2027.

- The Cash app has approximately 44 million monthly active users and over 100 million downloads.

- According to the source marketer, 1.31 billion people are expected to use mobile payment systems for cashless transactions by 2023.

- Between 2020 and 2025, mobile payments will grow at a CAGR of 26.93%.

- By 2024, the global mobile payment market is expected to be worth 3 trillion.

- By 2026, the mobile wallet market is expected to grow to $80 billion.

What is a payment app?

A cash app is a mobile application that lets you transfer and receive money electronically. It allows customers to execute transactions without cash or checks, making it simpler and easier. Payment applications allow transactions through various mechanisms, including bank transfers, credit or debit card payments, and peer-to-peer transfers.

To utilize a payment app, users must first create an account and link it to a bank, credit, or debit card. They can then use the app to make and receive payments to other individuals or companies. Other capabilities offered by certain payment apps include bill payment, stock or cryptocurrency investing, and online retail transactions.

How do payment apps work?

Here’s how a payment app usually operates:

- User Creates an Account: The user must first register an account and enter certain personal information, such as their name, address, and bank account or credit card information.

- User Links Their Account: Users can link it to their bank account or credit/debit card. This enables them to transfer and receive money online.

- User Initiates a Transaction: the user normally needs to provide the recipient’s details, such as their name or phone number, and the amount to be transferred. The application will then start the transaction.

- Payment is processed: The payment app will then complete the transaction, which could be a bank transfer, a credit or debit card transaction, or a peer-to-peer transfer.

- The recipient receives payment: After the payment is processed, the receiver will receive the funds in their payment app account. They can then use the app to transfer funds to their bank account or to make purchases.

- Payment App Tracks Transactions: The payment app will keep track of all transactions, which users may access and review over time. This can help consumers keep track of their finances and spending.

Benefits of Payment Apps

Payment apps let people manage their personal accounts and complete financial transactions quickly and efficiently.

Payment apps provide a number of advantages to users, including:

- Convenience: Payment applications enable users to send and receive money quickly and easily, eliminating the need for cash or checks. Users can make payments from their mobile devices, making paying bills, sharing expenses, and more easy.

- Payment apps utilize encryption and other security measures to safeguard user information and transactions. They often include two-factor authentication and other security measures to prevent unwanted access.

- Speed: Payment apps may transmit money virtually rapidly, allowing consumers to access their funds immediately. This is especially handy when a user needs to access funds quickly, such as to cover an emergency expense.

- Cheaper Fees: Payment applications frequently charge cheaper fees than traditional banks and financial institutions. For example, they might provide free transfers between users or charge a lower transaction price than typical wire transfers.

- Payment applications are accessible to everyone with a smartphone or other mobile device, allowing them to reach a wide range of consumers. This is especially beneficial for those who do not have access to regular financial services.

- Payment apps preserve a record of all transactions, which can help with budgeting and spending management. Users may quickly examine their transaction history and track where their money is going.

Features of Payment Apps

As a digital payment platform, the Payment App should provide certain characteristics that make it popular for sending and receiving money. Some of the important features are:

1. Peer-to-Peer Money Transfer

This is important to the development of P2P payment-based apps. The program must allow users to transfer payments in real time between themselves and other people in their contact list. It is also suggested that users be allowed to make contactless payments using QR codes.

2) Wallets

Integrating your wallet’s functionality within the app is advised to make transactions faster and easier. The wallet should also provide the option of paying using QR codes and sending money to contact numbers or your preferred bank.

3. Cash Card

The Cash card is a Visa debit card that may be used to pay for goods and services with your Payment App balance in stores and online. While it is not necessary at the moment due to the increasing demand for Apple cards or Cash cards, this concept will likely become the next key feature of Fintech applications built using P2P technology.

4. Multi-Account Type

Similar to cash, applications can benefit both businesses and individuals. It offers features and profiles that are suited to the amount of money being acquired and user segmentation.

5. Multi-factor authentication.

Multi-factor authentication protects consumers against illegal access and fraud by adding an extra layer of security to the payment app. Users must produce two or more pieces of documentation to validate their identification before they may access their account or conduct a transaction.

Users must sign in using a variety of methods, including OTP, email, or biometric authentication.

6: Link to your credit cards and accounts.

Fintech app developers allow clients to securely link their credit cards and bank accounts to the app. The payment app allows users to connect multiple banks and card accounts within the application.

Advanced Features for Creating an App Similar to Casha

The corporate sector will undoubtedly anticipate more from the continuously evolving app landscape. So, if you want to stand out and get an advantage, try including complex functionality in payment software like Cash.

01: In-App Payments

When you enable this feature, your clients can pay for their goods and services directly through the app. This greatly simplifies the payment process for your consumers.

02: Loyalty Programs

Businesses can utilize loyalty programs to reward repeat consumers and encourage them to use their applications. This is a wonderful choice for increasing your client retention rate and earnings.

03. Referral Programs

Referral programs are an excellent way to attract new users and increase the popularity of your app. You can reward users who recommend your software to their family and friends.

04: Push Notifications

Push notifications are one of the most effective ways to keep your users informed about the latest features, special offers, and other updates. It is one of the most effective strategies to keep consumers engaged in your software.

05: AI ChatBots

You can integrate artificial intelligence-powered chatbots into your payment application to provide 24-hour service to your clients. This is an opportunity to reduce customer service costs and improve your app’s overall user experience.

06: Digital Currency Exchange

The payment software allows users to buy and trade digital currency. This increases the app’s appeal to consumers wishing to invest in digital currencies.

How Much Does It Cost to Create a Payment App Like CashApp?

The cost of developing an app like Cash App varies substantially based on several aspects, including the complexity of the features, the platform(s) for which it will be developed, the team size and location, and the development timetable.

Some of the important aspects that can influence the cost of establishing a payment app are:

- Payment apps, such as the Cash app, are available on both the iOS and Android platforms. Thus, designing an app for both will be more expensive than developing one.

- Money transfers, bill payments, and investing are among the many functions available on the Cash App. The more complicated the functionality, the longer and more expensive the app’s development will be.

- Design: A well-designed software can entice more users, so investing in good UI/UX design is critical. However, this can raise the expense of development.

- The development team’s size and location can have an impact on the cost. Hiring a larger team or working with developers in more expensive countries can result in higher prices.

- Development timetable: A longer development timetable increases development costs because the team must work longer hours.

- It is recommended to connect with a professional payment app development business or developer to receive a more exact quotation, depending on your individual needs.

How Does the Cash App Ensure Application Security?

Payment apps have numerous security features to avoid fraud and hacking.

- A security lock based on PIN or TouchID.

- Real-time notifications of activity

- Two-factor authentication.

- If a user loses a card, their spending is instantly frozen.

Conclusion

Building a payment app, such as Cash App, can be a complicated and difficult process, but with the correct plan and approach, it can be a satisfying and profitable venture.

Given the numbers presented above, it is apparent that payment applications have a bright future ahead of them. You can also invest in payment app development. You should contact a top-tier mobile app development business to produce a successful payment app at an affordable price.